Early Bird Filing Starts December 1st — File Early, Get Paid Early.

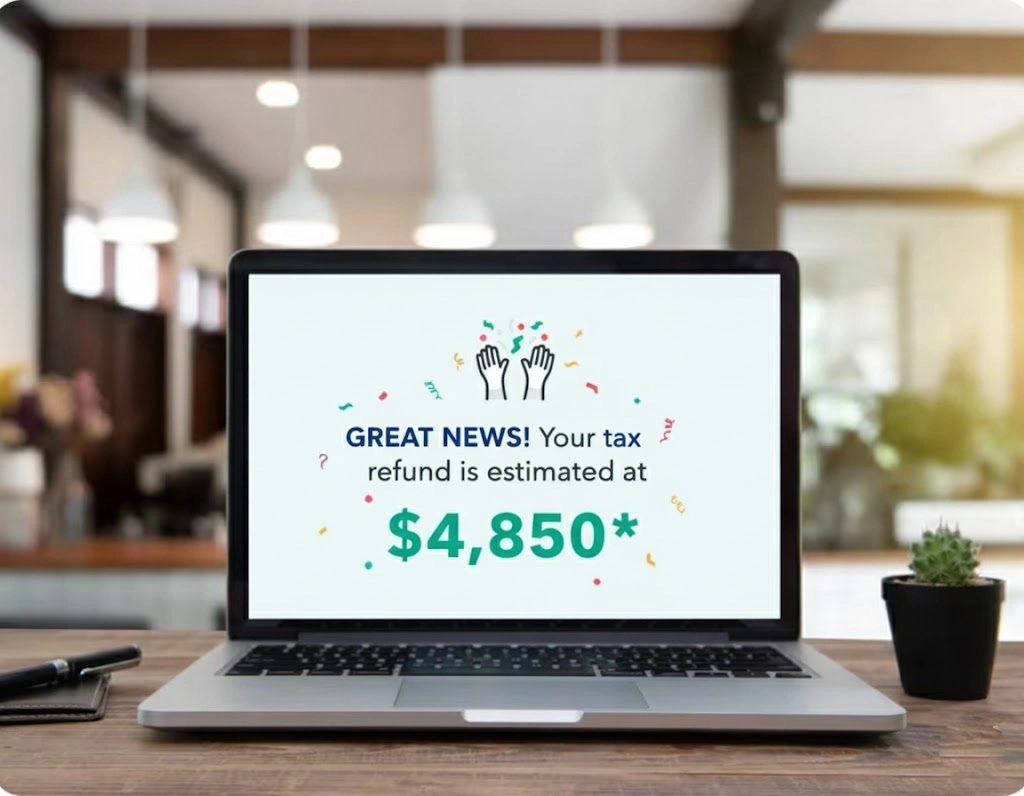

Estimate your tax refund with L1 Tax Pros

Answer simple questions and get a preview of your refund with our income tax calculator.

- Instant Refund Estimate

- Latest Tax Rules

- Secure & Private

- Simple & Accurate

L1 Tax Pros — Your Trusted Partner for a Smooth Tax Season

L1 Tax Pros is built to make filing taxes simple, fast, and stress-free. We believe everyone deserves clear guidance, trusted support, and maximum value when it comes to their tax return.

Our team uses proven systems to handle both personal and business filings with efficiency and care. Whether you’re filing early or catching up on past returns, we focus on accuracy, speed, and great service.

L1 Tax Pros is with you, before and after you file taxes.

Tax law changes

Key dates and deadlines

Tax tips, guides, and videos

Read why our customers love L1 Tax Pros

Rated 5 out of 5 stars by our customers.

L1 Tax made filing so easy

“This was my first time filing taxes online, and L1 Tax Pros made the whole process smooth and stress-free. Their questions were simple, and I got my refund faster than expected!”

Emma91, Texas

2024 Individual Tax FilingBest experience I’ve had with tax experts

“I’ve tried other services before, but none compare to L1 Tax Pros. Their experts were responsive, clear, and made sure I didn’t miss any deductions. Highly recommend them!”

DanielP23, Elpasso

2024 Self-Employed EditionTrustworthy and professional team

“I really appreciated how transparent and helpful the team at L1 Tax Pros was. They explained every step, double-checked my info, and I felt completely confident in my return.”

Ava08, Illinois

2024 Premium Tax ServiceTrustworthy and professional team

“Filing with L1 Tax Pros was quick, easy, and affordable. They found deductions I didn’t even know about. I’ll definitely use them again next year.”

Joseph89, California

2024 Business Tax FilingFile your taxes accurately and get your maximum refund— guaranteed

Your taxes, covered for life.

Your best tax outcome

Taxes done right

L1 Tax Pros Online: Important Details about Filing Simple Form 1040 Returns

you can file for free yourself with l1 Tax Pros Free Edition, or you can file with L1 Tax Pros Live Assisted Basic at the listed price.

Roughly 37% of taxpayers are eligible.

Examples of situations included in a simple Form 1040 return (assuming no added tax complexity):

- W-2 income

- Interest, dividends, or original issue discounts (1099-INT/1099-DIV/1099-OID) that don’t require filing a Schedule B

- IRS standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Student loan interest deduction

- Taxable qualified retirement plan distributions

Examples of situations not included in a simple Form 1040 return:

- Itemized deductions claimed on Schedule A, like charitable contributions, medical expenses, mortgage interest, and state and local tax deductions

- Unemployment income reported on a 1099-G

- Business or 1099-NEC income (often reported by those who are self-employed, gig workers, or freelancers)

- Stock sales (including crypto investments)

- Income from rental property or property sales

- Credits, deductions, and income reported on other forms or schedules

Get In Touch With Us

We’re here to make tax season easy. Whether you have a quick question or want to start your filing, our team is ready to help. Fill out the form, call, or visit us — and we’ll get back to you as soon as possible.

- Phone:(833) 924-4474

- Email: info@l1taxpros.com

- Office Hours: Monday – Friday | 9 AM – 6 PM (PST)

- Address: 4050 Rio Bravo st ste 210 El Paso, TX , 79902